Solving the “Invulnerable Customer” Problem

Often, consumers don’t buy products because even though they recognize a risk exists, they don’t think they will be victims. The belief may be irrational, but they see themselves as invulnerable. So, they don’t buy life or disability insurance, they don’t invest in healthcare products products or services, they don’t join a gym, or take other common and desirable steps to protect themselves. This poses a problem: what’s the best marketing strategy for consumers who seemingly believe in their own invulnerability?

What, Me Worry (about Germs)?

The prescription for this marketing dilemma was found in a hospital, of all places. Can you imagine a group likely to be more careful about hand-washing than healthcare professionals in hospitals? Not only are they well educated about hand hygiene practices and the reasons for them, but they actually see patients who suffer from the same kinds of infections that can be transmitted when hands aren’t washed properly. Surprisingly, according to Penn psychologist Adam Grant, even among health care professionals hand-washing practices leave a lot to be desired.

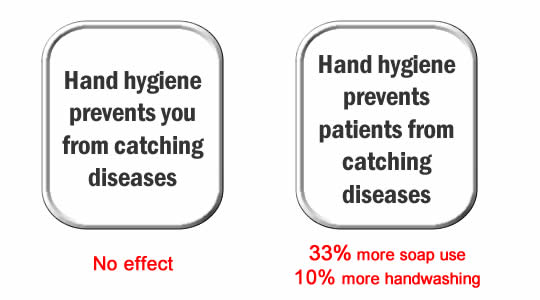

Grant attributes this behavior to a feeling of invulnerability on the part of the healthcare pros. This feeling is amplified by the fact that they are exposed to germs often in the course of their work but rarely become ill. So, Grant conducted an experiment by placing a sign next to a hand hygiene area. One version of the sign read, “Hand hygiene prevents you from catching diseases,” while another version said “Hand hygiene prevents patients from catching diseases.”

Bearing out the invulnerability theory, the sign that pointed out the threat to the healthcare professionals didn’t change their behavior at all. In contrast, the sign that changed just one word but pointed out the danger to patients (a group seen as vulnerable to disease) increased the use of soap and sanitizing gel by 33% and boosted the probability that the healthcare pros would wash their hands by 10%. (See Science Daily and the original paper. HT to Wray Herbert.)

Business Applications

This data is highly actionable not just for soap and sanitizer suppliers, but all types of companies that offer some kind of protective product. Whether it’s disability insurance or bicycle helmets, sales may not be made because some customers think a low-probability event won’t happen to them. They acknowledge that people do become ill or pitch over the handlebars of their bike, but assume that they are sufficiently healthy, careful, or lucky to avoid that fate themselves.

The key to selling these “invulnerable” customers is to point out the risks not to them, but to others. Those others could be family members, for example, or others they endanger (like the patients in the hospital study).

For an invulnerable customer, selling a car based on safety features won’t work unless it is put in the context of protecting family members, particularly when another driver causes an accident. That approach addresses invulnerability in two ways – first, it’s more believable to the customer that a child could be injured than himself, and second, it’s more likely that someone else will cause an accident than he will. Together, these elements create a more compelling sales message than one which tries to convince the customer of his own susceptibility to an accident.

Many products are sold on the basis of self-concern, and rightly so. But, if that’s not working with some customers, alter the message to reflect the risk to others!

Is there a “protection” product you know you should buy, but have put off purchasing because you think the odds are high that you won’t need it? Leave a comment and share your feelings of invulnerability!