How to Use Framing to Sell More Warranties and Service Contracts

A single hailstorm changed me from rational to irrational. It started with $12,000 damage to my car and $10,000 damage to my wife’s car. Then we needed a new roof on our house. With our insurance deductibles on everything maxed out, we became irrational. What follows is my confession to bad math and your roadmap to selling more warranties and service contracts.

Rationality demands that you do the math and make the choice that makes the most mathematical sense. We did that. Well, sort of. We did do the math and evaluated the options. Then we made an irrational choice because it felt good. Despite both math and experience arguing otherwise, we decided to pay higher premiums in order to lower the deductible on our home insurance from 2% to 1%. Why is this an irrational choice?

Both my wife and I have been previously married with separate households. In our combined experience of 50 years (25 years each), neither of us had previously suffered damage from a hailstorm. Neither of us had ever filed a damage claim on our house. This was the one and only time a lower deductible would have benefited us. Rationality would conclude that it’s unlikely to happen again anytime soon. So, why were we perfectly comfortable making an irrational choice?

Understanding the importance of framing

Framing – or putting the terms of a decision into a strategic context – can override logic and reason. Dr. Dan Ariely wrote Predictably Irrational, an entire book about the irrationality in purchasing decisions. Ariely’s book is based on two key premises. The first is that we humans, even the seemingly rational, are indeed irrational in our buying. The second is that this irrationality is actually predictable.

Similarly, Stanford Professor Amos Tversky and his colleague Daniel Kahneman conducted a series of studies to test human irrationality, and the published results demonstrate the power of framing over the power of logic[1].

The exact wording for one of Tversky & Kahneman’s studies is shown in below in Problem #1 and Problem #2. How would you answer their survey?

Problem #1:

Consider the following two-stage game. In the first stage, there is a 75% chance to end the game without winning anything, and a 25% chance to move into the second stage. If you reach the second stage you have a choice between:

A sure win of $30

80% chance to win $45

Your choice must be made before the game starts, i.e., before the outcome of the first stage is known.

Problem #2:

Which of the following options do you prefer?

25% chance to win $30

20% chance to win $45

What are your preferences?

If you’re like the original survey pool, you probably chose A in Problem #1 without hesitation. You probably had to deliberate more on Problem #2. The original test group overwhelmingly chose A in Problem #1 (78%), while 58% chose B in problem #2. Even though both problems are mathematically identical.

25% X 100% X $30 = 25% chance to win $30

25% X 80% X $45 = 20% chance to win $45

Why does Problem #1 drive more polarization than Problem #2? Framing option A in Problem #1 in pseudocertainty makes it more desirable. Explicitly stating a “sure win of $30” overpowers the stated reality that there is only a 25% chance of reaching stage 2. When you remove that pseudocertainty, the preference flips from 78% favoring choice A to 58% favoring choice B. Not only did the preference flipped, but the margin also shrunk.

Wouldn’t you like to add more predictability at greater margins of certainty to your business? Find ways of deploying pseudocertainty into your service offerings. As an example, what’s your service contract renewal rate? What percentage of your service contract customers found it beneficial? Can you say that 90% of your service contract customers found it beneficial and chose to renew? There’s your pseudocertainty. You’ve moved the reference point to the other side of the first event and it changed the framing.

The framing in the example above makes a difference, but there’s a weakness in it. Both problems are framed in the context of gain. Gain is exciting, but it’s not your most powerful force. The influential author of the book Influence, Dr. Robert Cialdini, often highlights that people are more motivated to minimize loss than to maximize gain.

“People seem to be more motivated by the thought of losing something than by the thought of gaining something of equal value.”[2]

When you’re selling a warranty or service contract, loss is your friend. The moment someone experiences loss, your probability of selling a service contract skyrockets. To demonstrate this point, we conducted some tests of our own.

How to use 'loss framing' to sell warranties and service contracts Share on XAmbiguity, probability, and certain loss – a practical example

Selling service contracts can be difficult. But this is often because of how and when you present them. You can induce pricing fatigue when you’re an expensive system with many line items. Another line item with a questionable benefit isn’t very compelling.

Consider the cash register market for restaurants and bars. Restaurant cash registers are basically computers. You’ve got the server, the terminal (cash register), printers, power strips, and more. Customers look at your quote and are often shocked to see that they’re paying $1,500 for each terminal and $400 for a small thermal printer. Their reference point for printers is whatever they saw on their last visit to Best Buy. This feels like robbery. Then they’re told they need a service contract for $1,100 per year. At that point, they’ve had enough and say, “No, thank you!”

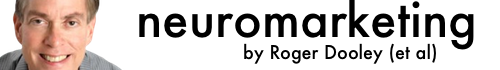

We put this scenario to the test below. Notice how the responses change based on the framing. In the first test, we offered the service contract with no framing. Can you guess the results?

You just purchased 3 cash registers for your office for a total price of $4,500. You are offered an optional support plan for $1,100 per year that covers the support hotline. Without the support plan, each support call costs $50.

Please select the option you would choose.

Only 19% of our test group elected to get the service contract, while 81% said no. For our next test, we added some framing.

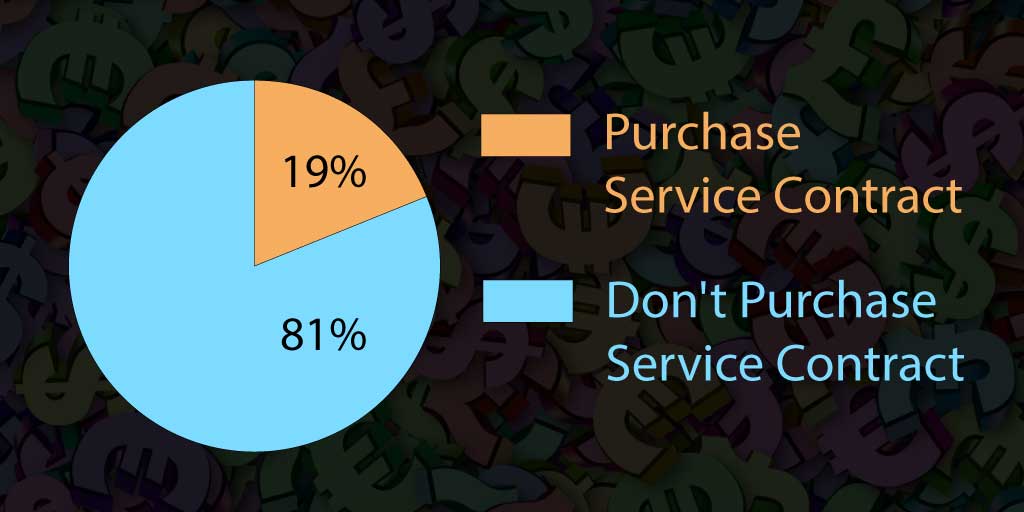

As in the first question, you just purchased 3 cash registers for your office for a total price of $4,500. As above, you are offered an optional support plan for $1,100 per year.

But before you choose, you are told that 50% of customers call the support hotline twice a month, 30% of customers call the support hotline once a month, and 20% of customers rarely call the support hotline.

As above, each call costs $50 unless you purchase the support plan. With this new information, please select the option you would choose.

Adding this simple framing almost doubled the number of people electing the service contract. Like the Tversky & Kahneman test, you are giving a probability of outcome. This helps you frame the value of the service contract to your individual risk profile.

Despite nearly doubling the number of people purchasing the service contract, the majority still declined. So, how do you sell to them? Your best opportunity to sell a warranty or service contract is immediately after someone experiences loss. You can see that below in our third framing of the service contract.

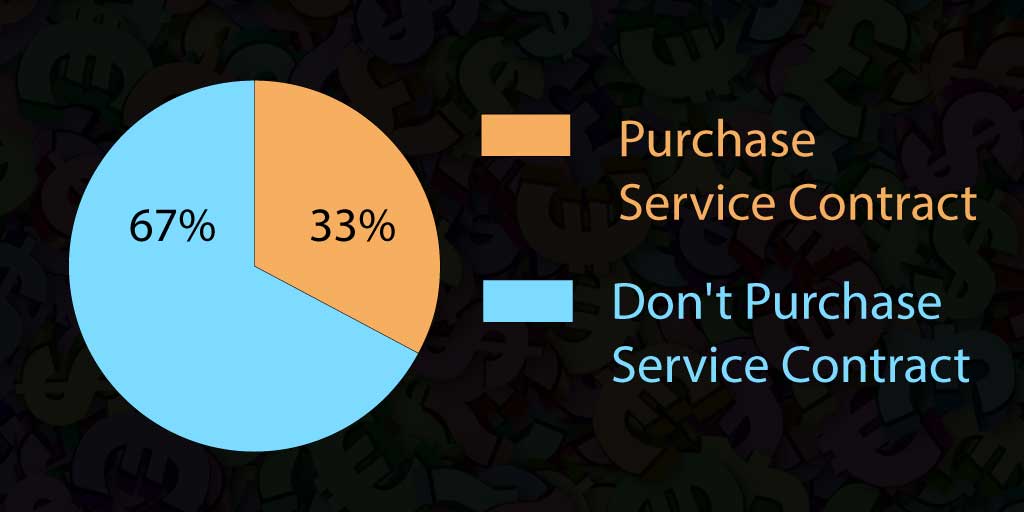

Assume you purchased the 3 cash registers for a total of $4,500, but you decided against buying the support plan.

For the first 2 months, you don’t need to call the support hotline. But in the third month, you start having multiple problems you can’t solve on your own. After trying to solve the problems yourself, you eventually call the support line. You’ve got 3 separate issues that result in 3 calls at a total cost of $150.

At this point, the support hotline offers to enroll you in the annual support plan. Your $150 applies to the plan, so you only pay an additional $950 to cover the next 11 months.

Please select the option you would choose.

At this point, 66% of respondents chose to get the service contract. Changing the framing doubled again the percentage of people electing the service contract. More importantly, look at the math on this scenario. They averaged one call per month, which would be $50 per month without the service contract. If that average continued over the next 11 months, they would pay a total of $550 for service calls. But instead of paying per call, the majority elected to get a service contract at almost twice the cost.

Your best opportunity to sell a warranty or service plan is immediately after someone experiences loss. This is identical to my newfound willingness to pay the premium for a 1% deductible on my home insurance after the hailstorm. No, the math doesn’t make sense, but I’m ok with that. So were the respondents in our test.

Different industry – another service contract

You can easily understand the importance of maintaining the integrity of sound-proof rooms for hearing tests. Without that integrity, the test results are uncertain and that can be a big deal when you’re calibrating a set of $5,000 hearing aids. But as you will see, our test group wasn’t keen on purchasing a service contract to maintain these rooms. Like the cash register example, our first framing is simple.

You manage an office that performs hearing exams and you purchase a sound-proof chamber to perform the audio exams. The chamber costs $10,000.

You are also offered a service contract for $2,000 per year. It covers annual inspections and any costs required to bring the chamber back into compliance.

Without a service contract, you pay $700 per inspection plus the cost of any repairs.

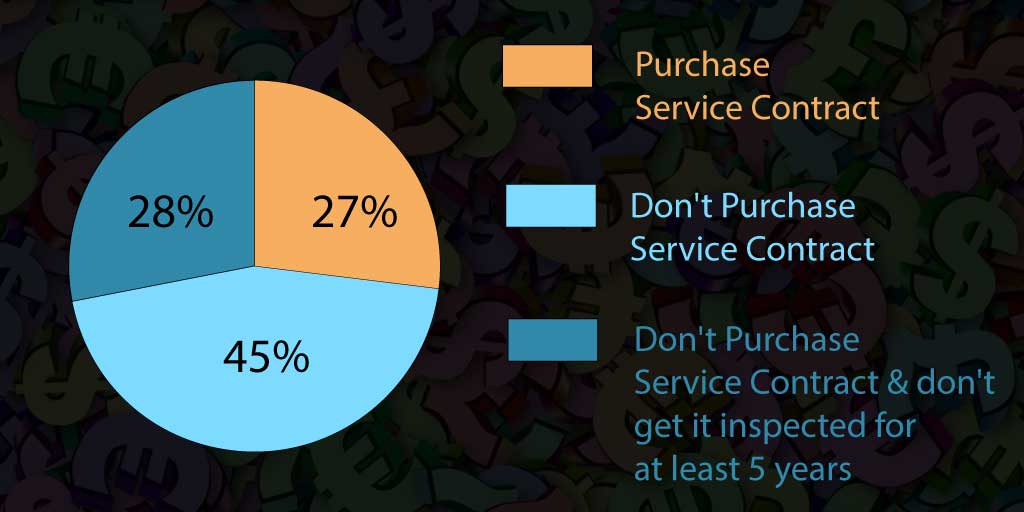

In this test, 27% of respondents elected to buy the service contract. In an interesting twist, 28% chose to ignore annual inspections and only get it inspected every 5 years. In total, 63% of respondents declined the annual service contract. Now, let’s frame it in the context of recent loss.

You manage an office that performs hearing exams and you purchase a sound-proof chamber to perform the audio exams. The chamber costs $10,000.

You are also offered a service contract for $2,000 per year. It covers annual inspections and any costs required to bring the chamber back into compliance.

Without a service contract, you pay $700 per inspection plus the cost of any repairs.

You decline the service contract.

After one year, you pay $700 for the inspection and discover that the chamber is out of compliance. It will cost an additional $500 to bring it back into compliance. The total cost is $1,200.

You are given the one-time option to purchase the service contract at the reduced price of $1,000 if you purchase it at the same time as your inspection and repair.

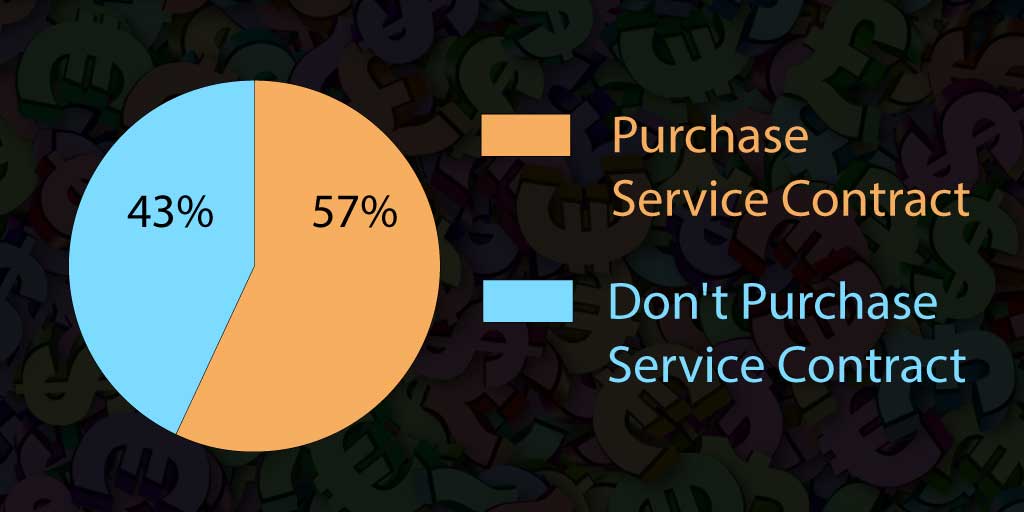

In the context of recent loss, 57% elected to get the service contract. You probably noticed we also layered an element of scarcity to the offer. But the respondents are paying $2,200 in total. This is more than the original service contract – which would have covered the cost of the repair. The one-time offer is presented as a discount. But the repair would have been covered anyway. So, you just sold a $2,000 product for $2,200 and everyone feels good about it.

In the context of recent loss, 57% elected to get the service contract. You probably noticed we also layered an element of scarcity to the offer. But the respondents are paying $2,200 in total. This is more than the original service contract – which would have covered the cost of the repair. The one-time offer is presented as a discount. But the repair would have been covered anyway. So, you just sold a $2,000 product for $2,200 and everyone feels good about it.

The respondents just experienced loss, and their urge to protect against future losses is in hyperdrive. This is an excellent time enroll them in a service contract. In the example above, they may feel like they are insuring against a future $1,200 service call by purchasing $1,000 of insurance. That makes mathematical sense. Would their behavior change if it didn’t make mathematical sense?

You manage an office that performs hearing exams and you purchase a sound-proof chamber to perform the audio exams. The chamber costs $10,000.

You are also offered a service contract for $2,000 per year. It covers annual inspections and any costs required to bring the chamber back into compliance.

Without a service contract, you pay $700 per inspection plus the cost of any repairs.

You decline the service contract and decide to only inspect the chamber once a year.

After one year, you pay $700 for the inspection and discover that the chamber is out of compliance. It will cost an additional $250 to bring it back into compliance. The total cost is $950.

You are given the one-time option to purchase the service contract at the reduced price of $1,000 if you purchase it at the same time as your inspection and repair.

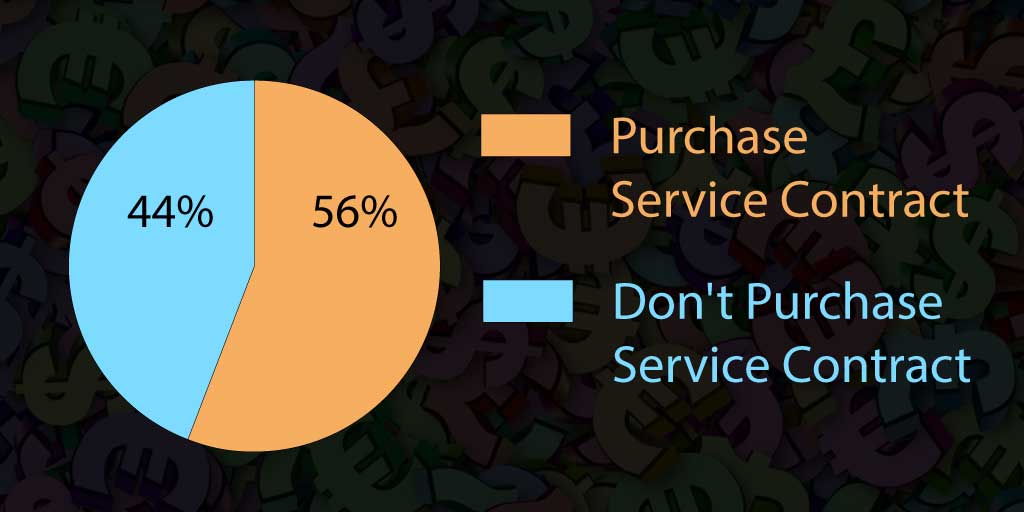

Despite moving the price point, the response was statistically identical to the last example – 56% purchased the service contract. Introducing the context of loss with a layer of scarcity moved the needle from 27% to 56% electing to get the service contract. Remember that 28% said they wouldn’t get the chamber inspected for 5 years! This is significant movement.

As the vendor, you may not feel as good about this result. In the prior scenario, you were able to sell a $2,000 product for $2,200, whereas in this scenario you’re only getting $1,950. Yes, in the single-transaction world, that is a good point. But the concept of consistency and its impact on lifetime value (LTV) might change your mind.

Consistency and lifetime value (LTV)

Your single focus should be selling your warranty or service contract at least once. Don’t get distracted by fears that you may be a couple of dollars behind your goal. It is easy to focus on the $50 shortfall in the last example and try to find some way to remedy it. You will find your remedy in a concept called “consistency.” Focus on selling the first service contract, even at a loss, and the consistency principle will go to work for you. Dr. Cialdini defines consistency as follows:

“Once people make a decision, take a stand or perform an action, they will face an interpersonal pressure to behave in a consistent manner with what they have said or done previously”.[3]

When you sell the first warranty or service contract, selling the renewal is much easier (assuming it adds value – more on that later). As our results show, selling the first service contract can be hard. Engineer the scenario so that they enroll the first time, and they will most likely renew. You’ve got two hurdles to overcome: One, to sufficiently convince the first individual that the expenditure is worth taking to the next level of approval; and two, getting approval to become a line item in the budget. This process applies whether you’re up against a home budge or a business budget. Either way, you should celebrate the day someone adds your service contract to as a line item. Renewals are much easier after that.

Individual transactions matter less when you focus on lifetime value. If you sell me multiple service contract renewals at a net profit of $1,000, are you ok with losing $50 on the first sale? I hope so, because that’s a 1,900% ROI. Do what it takes to sell your first service contract and then put the power of consistency to work for you.

Please don’t be sleazy

Single-transaction customers are the domain of sleazy marketers and companies who don’t add value. Hopefully that’s not you. You want to focus on maximizing lifetime value. Your best path to maximizing your lifetime value is maximizing the value to your customer. When Sam Walton was alive, Walmart was a great company that delivered value. Now they just focus on price. (There is a difference.) Walmart quit focusing on the customer and now their biggest threat is Amazon. Yes, there are questions about how Jeff Bezos treats employees. But his treatment of Amazon customers is world class. Both Sam Walton and Jeff Bezos made the top-10 richest list through a relentless focus on serving their customers in a way that adds value.

Your warranties and service contracts should add value. They can’t be gimmicks. You are making some sort of trade with your customer, such as trading revenue predictability for a lower cost of service. In the case of my home insurance, I’m trading peace of mind through risk mitigation for a few extra dollars every month. But it’s not a trick or a gimmick.

Publishing this type of research concerns me because of the potential for abuse. If you’re not adding value to your customers, please don’t call us to ask us to help gimmick your customers. We won’t do it. If you are considering some of these methods, bolster them by relentlessly adding value to your customers. That is your most profitable path anyway.

Pulling it together

Your customers have different risk profiles. Encounter them at different points in the journey with offers that speak to their unique needs. For some, that will be at the initial sale. Of course, you want to frame it in a way that helps them assess their risk as we did in the second cash register example. Others won’t be interested until they experience loss. You should anticipate that willingness and have an offer ready for them at that time.

You may say that your customers are analytical and will never fall for these Jedi mind tricks. But these forces actually work on people of all types. If anything, those who believe they are most immune are probably the most vulnerable. Take me, for example. I am an analytical’s analytical. On the Myers Briggs personality test, I consistently max out the “T” on the thinking(T)/feeling(F) scale on decision making. I’ve got a master’s degree in electrical engineering and have always been excellent at math. Despite a strong list of analytical credentials, a single hailstorm convinced me to pay more in order to change my home insurance deductible from 2% to 1%. The math doesn’t work, but I still feel good about my choice.

A psychology-based approach to sell 4x more warranties and service contracts Share on X

[1] The Framing of Decisions and the Psychology of Choice, Amos Tversky; Daniel Kahneman, Science, New Series, Volume 211, Issue 4481 (Jan. 30, 1981), 453-458.

[2] The Persuasion Handbook: Developments in Theory and Practice, Keltonv. L. Rhoads and Robert B. Cialdini, Sage, 2002, Chapter 26, page 513.

[3] The Persuasion Handbook: Developments in Theory and Practice, Keltonv. L. Rhoads and Robert B. Cialdini, Sage, 2002, Chapter 26, page 513.